Professional Indemnity Insurance for Inspection Companies

Protect Your Business Against Costly Professional Errors

As the owner of an inspection company, you know better than anyone that making mistakes is human, but the consequences can be significant.

Professional Indemnity Insurance provides the financial protection you need against claims arising from professional errors, negligence, or incorrect advice. This allows you to conduct your business without worries.

What is Professional Indemnity Insurance?

Professional Indemnity Insurance, also known as a Professional Liability Insurance, protects you and your employees from the financial consequences of errors, negligence, or incorrect advice in your work.

Despite your best efforts, mistakes can happen, and a client may suffer damages as a result of your work or advice. With this insurance, you don’t have to worry about high costs if something goes wrong.

By covering legal expenses and damages, it allows you to focus on your work with confidence, knowing you are well protected from financial risks associated with your profession.

What Does Professional Liability Insurance Cover?

With Professional Liability Insurance, you can count on coverage for, among other:

- Financial damage resulting from professional errors.

- Legal costs in case of liability claims.

- Costs for restoring reputational damage after a claim.

- Loss or damage of important documents.

What Does Professional Indemnity Insurance Not Cover?

- Personal injury to individuals

- Damage caused to third-party property

- Damage caused intentionally

- Damage due to financial crimes such as theft, fraud, or forgery

- Damage to your own property or to employees

- Fines or penalties imposed by a court

- Damage from cyber incidents unless specifically insured

- Liability as a director, commissioner, or supervisor

- Damage caused by failure to achieve promised results

- Damage caused by exceeding cost estimates or timelines

Optional Coverages:

Run-off and Retroactive Coverage

You can choose to insure the retroactive risk (prior acts). This means you are also covered for damage caused before the policy start date. Typically, you can choose a retroactive period of 1, 2, or 3 years.

Additionally, it is possible to cover the run-off risk (tail coverage) at the end of the policy. This means that after the policy ends, you are still insured against claims related to the insured period.

Business Liability Insurance

You can also insure Business liability as part of your coverage. This means that you are covered for damage your company accidentally causes to others or their property, for example, if a visitor trips in your office.

By combining both insurances, you are better protected against both professional errors and general business risks.

Who needs Professional Indemnity Insurance?

Examples of Covered Damages

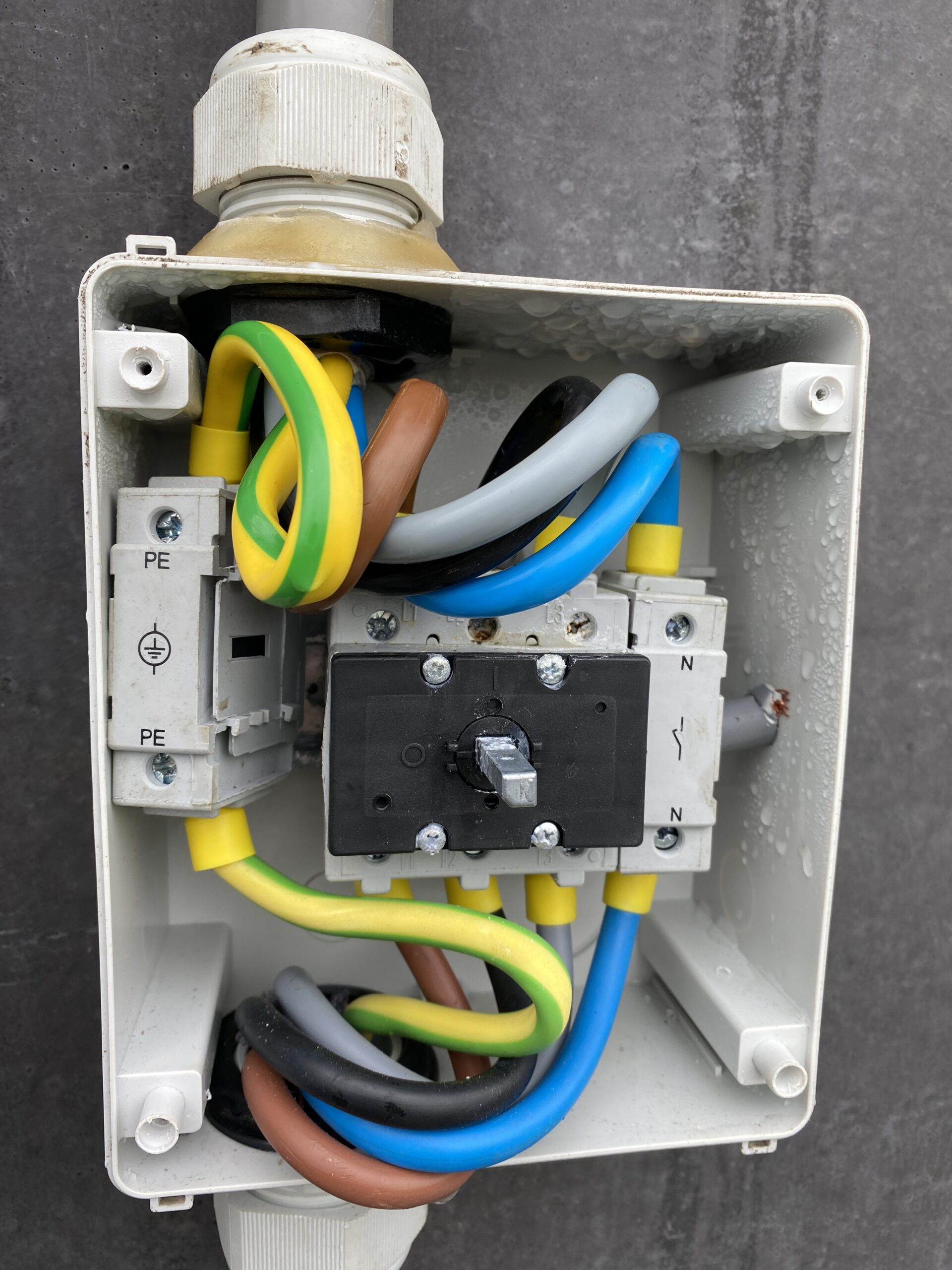

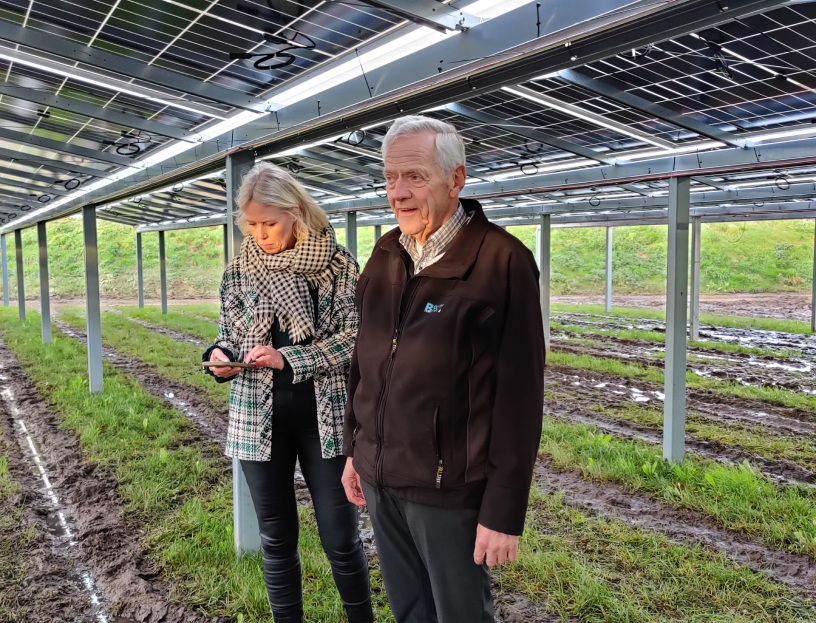

Improper Risk Assessment

An inspection company carries out a Scope 12 inspection at a solar farm and assesses, among other things, the condition of the cabling and inverters. The inspector concludes that everything is compliant. Several months later, a fire occurs as a result of a faulty connector, leading to significant financial damage to the solar farm. The owner holds the inspection company liable for the faulty assessment. The professional liability insurance covers legal costs and any damages.

Erroneous Reporting

After a Scope 12 inspection, an inspection report is produced stating that the solar system fully complies with the standards. The installer relies on this report and makes no further checks. After several months, it turns out that certain connectors had not been properly secured, leading to loss of revenue for the owner. The owner claims this loss from the inspection company because the report contained incorrect information. The insurance company covers the financial consequences of the professional error.

What Does Professional Liability Insurance Cost?

The premium depends on various factors, including:

- Your profession

- The business structure

- Your annual turnover

- The insured amount

- The deductible you choose

- Your business activities and the industry in which you operate

- The number of employees

- The additional coverages you choose

In general, the greater the risk, the higher the premium.

In addition to Professional Liability Insurance, entrepreneurs often take out:

What our customers say about us

“Thanks to Solarif, we always feel protected. Their in-depth knowledge of solar energy and the insurance market has strengthened our confidence. Time and again, they have shown us that we made the right choice.”

“Solarif’s personal approach is truly unique. From the first point of contact, we knew we were in good hands. Their transparency and reliability make them our top choice for solar energy insurance.”

“Solarif has helped us manage our risks effectively. Their professional approach is truly a breath of fresh air in this industry.”

Stay Updated with Solarif!

Want to stay informed about the latest developments in solar panels, inspections, and insurance for renewable energy?

Receive updates, the latest news, and tips!

Frequently Asked Questions

Professional liability insurance covers the financial damage caused by a professional error. It doesn’t matter who makes the mistake: you, an employee, or someone else working under your responsibility. Temporary workers, interns, or volunteers, as well as directors, commissioners, supervisors, and partners, are also insured.

Yes, the insurance premium is tax-deductible. The premium is considered a cost. Therefore, you can deduct the premium from your profit when filing taxes.

Contact us immediately. We will assist you with handling the claim and ensure the proper support. To report a claim or for more information on the next steps, visit our informative page on reporting claims. Read more about reporting claims!

Here are the differences:

Professional Liability

In certain professions, you can cause financial damage to a client, for example, due to a design error or incorrect financial advice. Professional liability insurance covers this form of damage.

Business Liability

When others suffer injury or material damage due to your products or activities, you are liable for it. The damage resulting from this is covered by business liability insurance.

Directors and Officers Liability

As a director, commissioner, or supervisor, you can be personally held liable for damage resulting from your decisions. You are required to compensate for this damage yourself. Directors and officers liability insurance covers this form of damage.

Professional liability insurance, also known as Professional Indemnity Insurance, is not legally required for inspection companies. However, a client or customer may require you to take out professional liability insurance. Professional indemnity insurance is wise anyway if you provide advice or services.